In times of economic uncertainty, it’s important to have a solid investment plan in place. One option that many people turn to is investing in gold. Not only is gold a valuable and stable asset, but it also has the potential to protect against economic downturns. In this beginner’s guide, we will explore the benefits of investing in gold and how it can serve as a safeguard for your finances during times of financial instability. Whether you’re a seasoned investor or just starting out, this article will provide valuable insights on how to protect your wealth through the power of gold. So let’s dive into the world of gold investing and discover how it can benefit you in the long run.

Investing in gold can be a wise decision for those looking to protect their investments in uncertain economic times. But for beginners, the world of gold investing can seem daunting and overwhelming. This guide aims to provide a clear and easy-to-understand overview of the various options available for investing in gold and how to protect against economic downturns.

One option for investing in gold is buying and storing physical gold. This can provide a sense of security and ownership, but it also requires proper storage and may come with additional fees. Another option is investing in gold stocks or ETFs, which can offer a more diverse portfolio and potentially higher returns, but also carries its own set of risks.

Before making any investment decisions, it is important for beginners to have a good understanding of the current state of the gold market. Factors such as supply and demand, inflation rates, and geopolitical events can all have an impact on the price of gold. Staying informed and regularly monitoring these factors is crucial when investing in gold.

It is also important to consider the potential risks and rewards associated with investing in gold. While it is often seen as a safe haven during economic downturns, gold is not immune to market fluctuations. Having a long-term investment strategy in place and understanding the potential risks can help mitigate these fluctuations and increase the chances of a successful investment.

Lastly, this guide will cover the benefits of opening a gold IRA account. This allows individuals to invest in gold through their retirement savings and offers tax advantages. It can also provide a secure way to diversify one’s retirement portfolio.

In summary, by considering all the options and understanding the current state of the market, beginners can enter the world of gold investing with confidence and protect against economic downturns. With proper research and planning, investing in this precious metal can potentially yield great rewards.

Different Ways to Invest in Gold

Investing in gold can be a smart move for anyone looking to diversify their portfolio and protect against economic downturns. But before jumping into the market, it’s important to understand the different ways to invest in gold and the risks and benefits associated with each option.

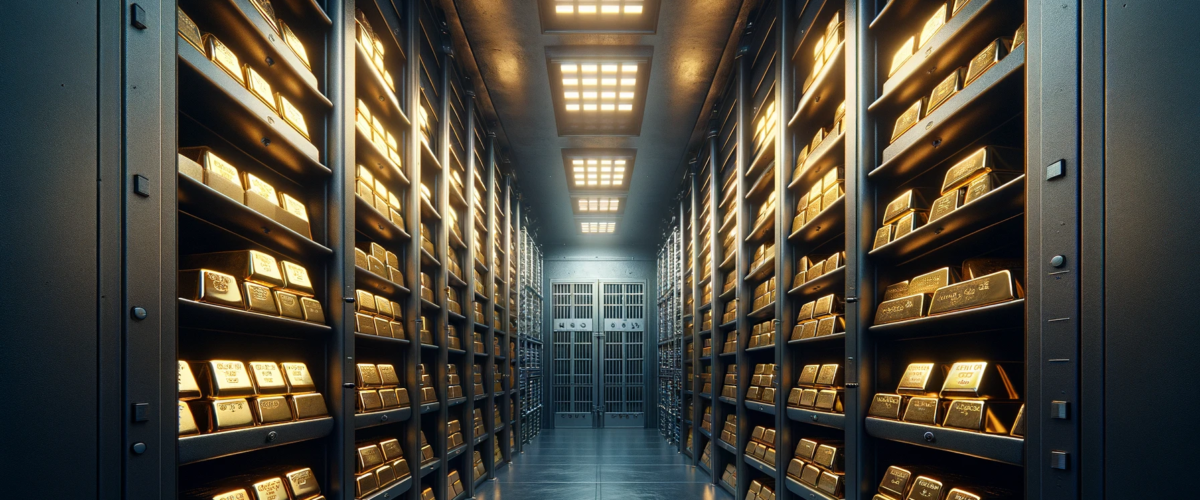

One of the most common ways to invest in gold is through physical ownership, which involves purchasing gold bars, coins, or bullion. This option allows investors to physically hold their gold and have direct ownership, but it also comes with the risk of storage and potential for theft.

Another popular option is investing in gold ETFs (exchange-traded funds), which are securities that track the price of gold. This allows investors to indirectly invest in gold without physically owning it. ETFs offer flexibility, low fees, and easy liquidity, but they also come with the risk of market volatility and potential for losses.

For those looking for a more hands-off approach, investing in gold mining stocks is another option. This involves buying shares in companies that mine for gold, and can provide potential for higher returns but also comes with higher risk.

Lastly, there is the option of investing in a gold IRA (individual retirement account), which allows individuals to hold physical gold within their retirement account. This option offers tax benefits and protection against inflation, but also comes with strict regulations and fees.

Understanding the Gold Market

When it comes to investing in gold, understanding the market is key to making informed decisions. There are several factors that can impact the price of gold, including supply and demand, economic conditions, and global events.

Supply and demand plays a big role in the gold market. Gold is a finite resource and is mined at a relatively steady rate. However, demand for gold can fluctuate, causing prices to rise or fall. For example, during times of economic uncertainty, when investors are looking for safe-haven assets, demand for gold tends to increase, driving up its price.

Economic conditions also play a significant role in the price of gold. When the economy is strong and stock markets are performing well, investors may be less inclined to invest in gold. On the other hand, during economic downturns, investors tend to turn to gold as a way to protect their investments.

Global events can also have an impact on the price of gold. Political instability, natural disasters, and other major events can cause fluctuations in the gold market. It’s important for investors to stay informed about current events and how they may affect the price of gold.

To stay informed about the gold market, there are several resources available. Keeping an eye on financial news outlets and market reports can provide valuable insights into the current state of the market. Additionally, following trusted analysts and experts in the field can offer valuable perspectives on future trends.

By understanding these factors that can impact the price of gold and staying informed about current events, beginners can feel more confident in entering the gold market and protecting their investments against economic downturns.

Risks and Rewards of Investing in Gold

Investing in gold can be a lucrative opportunity, especially in times of economic uncertainty. However, like any investment, there are risks associated with it that should be carefully considered before entering the market. In this section, we will discuss the potential risks of investing in gold and how to mitigate them.

Market Volatility

One of the main risks of investing in gold is its volatility in the market. Gold prices can fluctuate greatly, sometimes even on a daily basis. This can be nerve-wracking for new investors who are not used to such fluctuations and may lead them to make impulsive decisions.

To mitigate this risk, it is important to have a long-term perspective when investing in gold. Instead of focusing on short-term gains or losses, look at the bigger picture and consider gold as a long-term investment.

Liquidity

Another potential risk of investing in gold is its liquidity. Unlike stocks or bonds, it may not be as easy to sell off your gold investments quickly. This can be a problem if you need immediate access to funds.

To mitigate this risk, it is important to have a diverse portfolio that includes other assets besides gold. This will provide you with more options and flexibility in case you need to sell off some of your investments for quick cash.

Custodial Risks

If you choose to invest in physical gold, there is also the risk of theft or damage. Keeping large amounts of gold at home can be risky, and storing it in a bank or other custodial facility also comes with its own set of risks.

To mitigate this risk, it is important to choose a reputable and insured custodian for your gold investments. This will ensure that your gold is safe and protected.

The Benefits of a Gold IRA

Investing in gold can be a smart move for beginners looking to protect their investments against economic downturns. But what makes a Gold IRA account different from other forms of gold investing? In this section, we’ll discuss the benefits of a Gold IRA and why it may be the best option for new investors.

A Gold IRA account is a type of Individual Retirement Account that allows you to invest in gold and other precious metals. Unlike traditional IRAs, which typically only allow for investments in stocks, bonds, and mutual funds, a Gold IRA gives you the option to diversify your portfolio with physical assets like gold. This can be especially beneficial during times of economic uncertainty, as gold tends to hold its value or even increase in value when other investments may be declining.

Another major benefit of a Gold IRA is its tax advantages. Just like with traditional IRAs, contributions to a Gold IRA are tax-deductible, and any gains made on your investments are tax-deferred until you withdraw them during retirement. This means you can potentially save money on taxes while also growing your wealth through gold investments.

Additionally, a Gold IRA offers protection against inflation. As the value of paper currency decreases, the value of physical assets like gold tends to increase. By investing in gold through a Gold IRA, you can protect your retirement savings from being eroded by inflation.

Lastly, opening a Gold IRA account is a relatively simple process. Most reputable gold dealers offer IRA accounts and can help you set one up. You can also choose to self-direct your Gold IRA, meaning you have control over which assets are invested in and how much is allocated to each investment.

In summary, opening a Gold IRA account can be a smart investment move for beginners because it offers diversification, tax advantages, protection against inflation, and ease of access. With a Gold IRA, you can confidently navigate the world of gold investing and protect your savings against economic downturns.

In conclusion, investing in gold can be a smart move for beginners looking to protect their investments against economic downturns. By understanding the various options available, staying informed about the market, and having a long-term investment strategy in place, individuals can potentially reap the rewards of this precious metal. Remember to always do thorough research and consult with a financial advisor before making any investment decisions.