Are you interested in diversifying your retirement portfolio? Have you considered investing in gold? Gold has long been considered a safe haven for investors, especially during times of economic uncertainty. And now, with the option of self-directed IRAs and precious metals IRAs, investing in gold has become even more accessible. In this beginner’s guide, we will provide an overview of self-directed IRAs and precious metals IRAs, and how they can help you invest in gold for your retirement. So, if you’re ready to learn about the benefits of a gold IRA account and how to get started, keep reading.

If you’re looking to diversify your investment portfolio, adding gold may be a smart move. One way to invest in gold is through self-directed IRAs and precious metals IRAs. These types of IRAs differ from traditional IRAs in that they allow you to invest in alternative assets, such as physical gold.

So, what exactly are self-directed IRAs and precious metals IRAs? Self-directed IRAs are retirement accounts that give you more control over your investments. Unlike traditional IRAs, which limit your investment options to stocks, bonds, and mutual funds, self-directed IRAs allow you to invest in a wider range of assets, including precious metals like gold.

Precious metals IRAs, on the other hand, are a type of self-directed IRA specifically designed for investing in precious metals. These IRAs allow you to hold physical gold as well as other precious metals like silver, platinum, and palladium. The main advantage of these types of IRAs is that they offer a way to diversify your retirement savings beyond traditional assets.

Now that we’ve covered the basics of self-directed IRAs and precious metals IRAs, let’s dive into the specifics of investing in gold. The first step is purchasing physical gold, which can be done through a variety of sources. You can buy gold from dealers or brokers, online platforms, or even directly from mints and refineries.

When buying physical gold, it’s important to do your research and choose a reputable dealer. Look for dealers who have been in business for a long time and have a good reputation. You’ll also want to consider the price of the gold being sold, as well as any fees associated with the purchase.

Once you’ve purchased your gold, you’ll need to think about how to safely store it. Some investors choose to store their gold at home, while others opt for a secure storage facility. Whatever option you choose, make sure to take necessary precautions to protect your investment.

Aside from physical gold, there are other ways to invest in gold within your self-directed IRA. One option is investing in gold stocks, which are shares of companies that mine or produce gold. This option allows you to indirectly invest in gold without physically owning it.

Another popular option is using gold ETFs (exchange-traded funds), which are similar to stocks but represent ownership in physical gold. These ETFs track the price of gold and can be bought and sold on stock exchanges, making them a convenient and liquid way to invest in gold.

It’s important to note that like any investment, there are risks associated with investing in gold. The price of gold can be volatile, so it’s important to do your research and understand the market before investing. It’s also important to consider the fees associated with buying and storing physical gold as well as any potential tax implications.

However, there are also potential rewards to investing in gold. Gold has historically been seen as a safe-haven asset, meaning it can help protect against inflation and economic uncertainties. It can also provide diversification for your portfolio, reducing overall risk.

In conclusion, self-directed IRAs and precious metals IRAs offer a unique opportunity to invest in alternative assets like gold. By understanding the basics of these types of IRAs and the process of investing in gold, you can make informed decisions about how to diversify your retirement portfolio. Just remember to do thorough research and consider the potential risks and rewards before making any investment decisions.

Understanding Self-Directed IRAs

If you’re looking to diversify your investment portfolio by adding gold, it’s important to understand the key differences between self-directed IRAs and traditional IRAs. While traditional IRAs are typically managed by a financial institution and limited to stocks, bonds, and mutual funds, self-directed IRAs give you more control over your investments and allow for a wider range of options, including precious metals such as gold.

With a self-directed IRA, you have the freedom to choose how your funds are invested, as long as they comply with IRS regulations. This means you can invest in physical gold, gold stocks, gold ETFs, and even gold IRA accounts. This flexibility allows you to tailor your investments to your specific goals and risk tolerance.

Additionally, self-directed IRAs often have higher fees compared to traditional IRAs due to the additional administrative work required. However, the potential for higher returns and the ability to diversify your portfolio with alternative assets like gold make it a worthwhile option for many investors.

Investment Strategies for Gold

When it comes to investing in gold, there are various options available for beginners. One popular option is investing in gold stocks, which are shares of companies that mine and produce gold. These stocks can provide exposure to the gold market without physically owning the metal.

Another option is investing in gold ETFs, or exchange-traded funds. These funds hold a portfolio of physical gold and track the price movements of the metal. This allows for easy buying and selling of gold without the hassle of storing physical bullion.

Other investment strategies for gold include purchasing physical gold through a gold IRA account. This type of account allows for tax-advantaged investments in precious metals, including gold. It is important to research and choose a reputable custodian for your gold IRA to ensure the safety and security of your investment.

No matter which investment strategy you choose, it is important to carefully research and understand the potential risks and rewards associated with investing in gold. The current state of the gold market should also be taken into consideration before making any investment decisions.

Risks and Rewards of Investing in Gold

When it comes to investing in gold, there are both potential risks and rewards to consider. Understanding these factors can help you make informed decisions and potentially maximize your profits.

One of the main risks of investing in gold is its volatility. The price of gold can fluctuate greatly due to a variety of factors such as economic conditions, political events, and supply and demand. This can make it a risky investment for those seeking stability in their portfolio.

However, the potential rewards of investing in gold cannot be ignored. Gold has historically been seen as a safe haven during times of economic uncertainty or inflation. This means that when other investments may be struggling, gold prices may rise, providing a hedge against losses.

In addition, investing in gold can also offer potential long-term growth. As the demand for gold increases, so does its value. This can lead to significant profits for investors who hold onto their gold for an extended period of time.

It’s important to keep in mind that like any investment, there is no guarantee of success when it comes to investing in gold. It’s crucial to carefully research and monitor the market before making any investment decisions.

What are Precious Metals IRAs?

Precious metals IRAs are a type of self-directed IRA that allows individuals to invest in physical precious metals such as gold, silver, platinum, and palladium. These IRAs offer investors the opportunity to diversify their portfolios by adding a tangible and historically valuable asset.

Unlike traditional IRAs, precious metals IRAs are not limited to paper assets like stocks, bonds, and mutual funds. Instead, they allow investors to hold physical precious metals in their retirement accounts, providing a level of security and stability in uncertain economic times.

One of the main benefits of investing in a precious metals IRA is the potential for long-term growth. Precious metals have historically held their value and even increased in value during economic downturns. This makes them a valuable addition to any investment portfolio.

In addition to potential growth, precious metals IRAs also offer tax advantages. Just like traditional IRAs, contributions to precious metals IRAs can be made with pre-tax dollars, reducing an individual’s taxable income for the year.

It’s important to note that there are specific rules and regulations regarding precious metals IRAs, including restrictions on which types of precious metals can be held and how they must be stored. It’s recommended to work with a reputable custodian who specializes in precious metals IRAs to ensure compliance with all regulations.

Buying Physical Gold

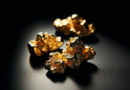

Investing in gold can be an attractive option for those looking to diversify their investment portfolio. Unlike paper assets, physical gold provides a tangible and secure form of wealth that has stood the test of time. However, buying physical gold requires careful consideration and understanding of the process. In this section, we will provide step-by-step instructions on how to buy physical gold for investment purposes.

The first step in buying physical gold is to decide on the form in which you want to invest. This can range from gold coins and bars to bullion and jewelry. Each form has its own advantages and disadvantages, so it is important to research and determine which one best suits your investment goals.

Once you have decided on the form of physical gold, the next step is to find a reputable dealer. It is essential to do your due diligence and only purchase from a trusted source to ensure the authenticity and quality of the gold. You can also consider purchasing from a government mint or a well-known precious metals dealer.

When making the actual purchase, it is important to negotiate the price and understand any additional fees that may be involved, such as storage or insurance costs. It is also recommended to purchase from a dealer who offers a buyback option in case you decide to sell your gold in the future.

After purchasing your physical gold, it is crucial to find a safe and secure storage option. This can range from a home safe or bank safety deposit box to using a professional storage facility. Whichever option you choose, make sure it is insured and easily accessible.

Overall, buying physical gold requires careful planning and consideration, but it can be a valuable addition to your investment portfolio. By following these steps, you can confidently invest in physical gold and potentially reap the rewards of this precious metal.

Investing in gold can be a smart way to diversify your portfolio and protect against economic downturns. By understanding the basics of self-directed IRAs, precious metals IRAs, and different investment strategies for gold, you can make informed decisions about how to enter the gold market as a new investor. Remember to always do thorough research and consult with a financial advisor before making any investment decisions.