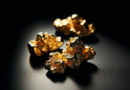

In the world of investing, gold stocks are often seen as a safe haven for investors. And with the recent surge in gold prices, many are looking to get in on the action by investing in large-cap mining companies. But before diving into this sector, it’s important to understand the basics of investing in gold stocks. In this beginner’s guide, we will cover everything you need to know about investing in gold stocks, including the types of gold stocks available and the benefits of investing in them. So if you’re new to the world of investing or simply looking to diversify your portfolio, read on to learn more about this lucrative sector.

As a beginner investor, you may be interested in exploring the world of gold stocks. Investing in gold can be an exciting and potentially profitable venture, but it’s important to understand the different types of gold stocks and how they fit into your overall investment strategy. In this article, we will cover everything you need to know about investing in large-cap mining companies, one of the most popular types of gold stocks.

First, let’s define what exactly large-cap mining companies are. These are companies that mine for gold on a large scale, with a market capitalization of over $10 billion. This sets them apart from other types of gold stocks such as junior mining companies, which are smaller and less established. Large-cap mining companies tend to have more stable operations and financials, making them a relatively lower risk investment compared to junior mining companies.

Now that we have a better understanding of large-cap mining companies, let’s explore the different ways you can invest in them. One option is through physical gold, where you purchase actual gold bars or coins and store them yourself or in a secure facility. This method allows you to have direct ownership of physical gold, but it also comes with storage and insurance costs.

Another option is through a gold IRA account, which is a retirement account that allows you to invest in gold and other precious metals. This type of account offers tax benefits and can provide diversification to your portfolio. However, there are strict rules and restrictions on withdrawals from a gold IRA, so it’s important to do your research before investing.

You can also invest in large-cap mining companies through gold ETFs (exchange-traded funds). These are investment funds that hold a basket of gold-related assets, including shares of large-cap mining companies. ETFs offer the convenience of stock-like trading and diversification, but they also come with management fees.

Now, let’s take a look at the current state of the gold market. Gold has historically been seen as a safe-haven asset, meaning investors turn to it during times of economic uncertainty. As such, the demand for gold tends to increase during times of market volatility, which can drive up its price. However, the value of gold can also be affected by factors such as interest rates and inflation.

When it comes to investing in large-cap mining companies, there are potential risks and rewards to consider. On the one hand, these companies have established operations and financials, making them a relatively lower risk investment in the gold market. However, they are still subject to factors such as gold prices and production costs, which can impact their profitability.

In conclusion, investing in large-cap mining companies can be a valuable addition to your investment portfolio. These companies offer stability and potential for growth in the gold market. However, it’s important to do your research and consider your risk tolerance before making any investment decisions. By understanding the different ways to invest in these companies and the current state of the gold market, you can make informed decisions and potentially reap the rewards of investing in this precious metal.

Investing in Physical Gold

One of the most traditional ways to invest in gold is by purchasing physical gold, such as coins or bars. This method allows you to physically own the gold and store it yourself or through a custodian. However, keep in mind that this method comes with additional costs, such as storage fees and insurance.

What are Large-Cap Mining Companies?

Large-cap mining companies are businesses that extract gold from the ground and sell it for profit. These companies typically have a market capitalization of over $10 billion and operate on a global scale. They are considered more stable than smaller mining companies, making them a popular choice for investors looking for long-term growth.

Gold ETFs

For those looking for a more hands-off approach, gold exchange-traded funds (ETFs) can be a good option. These are investment funds that track the price of gold and can be bought and sold on the stock market. They offer the advantage of liquidity and lower fees compared to physical gold investments.

Gold IRA Accounts

Another option for investing in gold is through a gold IRA account. This type of individual retirement account allows you to hold physical gold as part of your retirement portfolio. It offers tax benefits and can be a good way to diversify your investments.

However, there are strict rules and regulations surrounding gold IRAs, so it’s important to do your research before opening one.

Understanding the Gold Market

Before investing in gold, it’s important to have a basic understanding of the current state of the gold market. Factors such as supply and demand, inflation, and economic stability can all impact the price of gold. It’s also important to keep in mind that gold prices can be volatile and may not always go up.

Potential Risks and Rewards

Like any investment, there are risks and rewards associated with investing in gold stocks. On one hand, gold has historically been seen as a safe haven during times of economic uncertainty, making it a potentially valuable addition to a diversified portfolio. On the other hand, if the economy is performing well, the demand for gold may decrease, leading to a decline in prices.

Investing in large-cap mining companies can be a great way for beginners to enter the world of gold stocks. It’s important to understand the different types of gold investments and how they fit into your overall investment strategy. By doing your research and staying informed about the current state of the gold market, you can make informed decisions about your investments.