Investing in gold has long been considered a popular and reliable store of value. For centuries, gold has been a highly coveted precious metal, with a rich history dating back to ancient civilizations. Its intrinsic value and rarity have made it a sought-after asset for investors looking to diversify their portfolios and protect their wealth. In recent years, as the global economy has become increasingly volatile, the appeal of gold as a safe haven investment has only grown stronger. In this beginner’s guide, we will explore the basics of investing in gold, its potential benefits, and how you can get started with this timeless asset.

Gold has been a valuable asset for centuries, and with the current state of the economy, more and more people are turning to this precious metal as a way to diversify their investment portfolio. If you’re a beginner looking to enter the gold market, you’ve come to the right place. In this article, we’ll cover everything you need to know about investing in gold, from buying and storing physical gold to exploring different investment strategies and options.

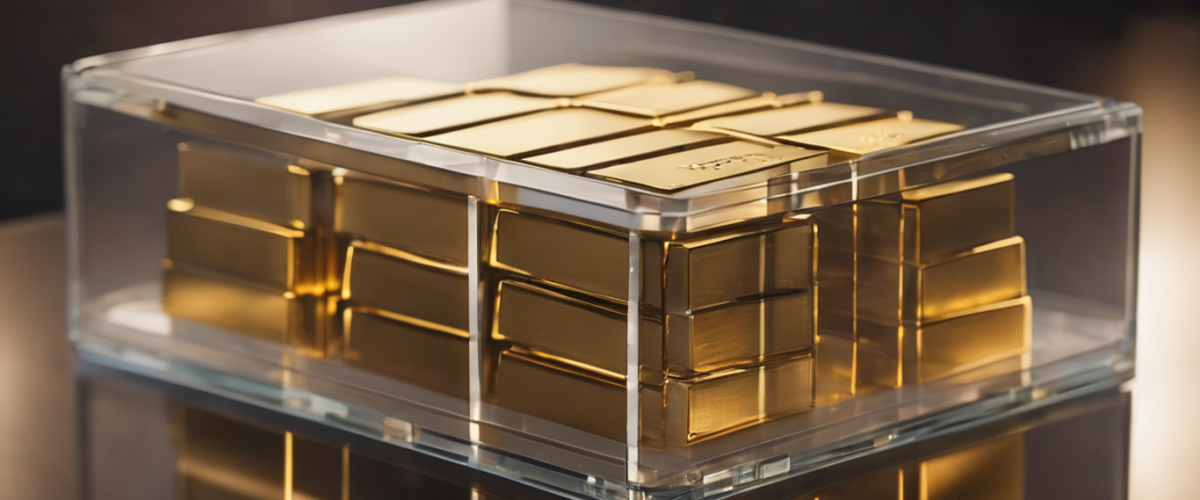

Firstly, let’s discuss the various ways you can buy and store physical gold. This includes purchasing gold bars or coins from reputable dealers, as well as storing them in a secure location such as a bank safe deposit box or a home safe. It’s important to ensure that your gold investments are properly insured to protect against any potential risks.

Next, we’ll delve into different investment strategies and options for gold. This includes gold stocks, which are shares of companies involved in the mining and production of gold, as well as gold IRA accounts, which allow you to invest in gold through your retirement savings. Another option is investing in gold ETFs (exchange-traded funds), which offer a convenient way to invest in gold without physically owning it.

We’ll also provide insights into the current state of the gold market and potential risks and rewards associated with investing in this precious metal. This will give you a better understanding of how gold prices are determined and what factors can impact its value. It’s important to stay informed about the market when investing in any asset.

To conclude, investing in gold can be a great way for beginners to diversify their investment portfolio. However, it’s important to carefully consider your options and do thorough research before making any investment decisions. By following the tips and information provided in this article, you’ll have a solid understanding of how to invest in gold and the potential benefits and risks involved.

Exploring Different Investment Strategies and Options

When it comes to investing in gold, there are several different strategies and options to consider. These include gold stocks, gold IRA accounts, and gold ETFs. Each of these options offers its own unique advantages and disadvantages, and it’s important to understand them before making any investment decisions.

Gold Stocks

Gold stocks are a popular way to invest in gold as they offer the potential for high returns. These stocks are shares of companies that mine, explore, or produce gold. The value of these stocks is tied to the price of gold, so when the price of gold rises, the value of the stock also increases.

Gold IRA Accounts

A gold IRA account is an individual retirement account that allows you to invest in physical gold. This option is particularly appealing for those who want to diversify their retirement portfolio and protect against inflation. However, it’s important to note that there are strict rules and regulations surrounding gold IRA accounts, so it’s crucial to do thorough research before opening one.

Gold ETFs

Gold ETFs, or exchange-traded funds, are a type of investment that tracks the price of gold. These funds hold a variety of assets including physical gold, futures contracts, and mining stocks. Investing in a gold ETF can offer diversification and liquidity, as well as low fees compared to other investment options.

Understanding the Current State of the Gold Market

The gold market is constantly changing and influenced by a variety of factors. It’s important for investors to have a good understanding of these factors in order to make informed decisions when it comes to investing in gold.

One of the main factors that impacts gold prices is the state of the economy. During times of economic uncertainty or instability, investors tend to turn to gold as a safe haven asset, driving up its demand and price. On the other hand, when the economy is performing well, investors may opt for riskier investments, causing a decrease in gold prices.

Another factor that affects gold prices is inflation. As inflation rises, the value of traditional currencies decreases, making gold a more attractive option as it holds its value over time. Additionally, political events and policies, such as changes in interest rates or trade agreements, can also impact the gold market.

It’s also important to note that the supply and demand for gold also play a significant role in its prices. When there is a high demand for gold, its price will increase, and vice versa. This can be influenced by factors such as jewelry demand, industrial usage, and central bank buying or selling.

By keeping an eye on these factors and staying informed about current events and market trends, investors can gain valuable insights into the current state of the gold market and make more informed decisions when it comes to investing in this precious metal.

How to Buy and Store Physical Gold

Investing in gold is a smart way to diversify your portfolio and protect your wealth. However, buying and storing physical gold can be intimidating for beginners. In this section, we’ll provide you with some helpful tips on how to purchase and safely store physical gold.

Tips for Purchasing Physical Gold:

1. Do your research: Before making any investment, it’s important to do your due diligence. Research the current market value of gold and compare prices from different dealers.

2. Buy from reputable dealers: It’s crucial to buy from a reputable dealer to ensure the authenticity of the gold. Look for dealers who are accredited by organizations like the Professional Numismatists Guild or the American Numismatic Association.

3. Consider the form of gold: Gold can be purchased in various forms such as bars, coins, or jewelry. Each form has its own advantages and disadvantages, so consider your goals and preferences before making a purchase.

4. Check for purity: The purity of gold is measured in karats, with 24 karat being the purest form. Make sure to check the purity of the gold before purchasing.

Tips for Safely Storing Physical Gold:

1. Choose a secure location: It’s important to store your physical gold in a secure location, such as a safe or a bank safety deposit box.

2. Keep it private: Avoid discussing your gold investments with others, as this can make you a target for theft.

3. Insure your gold: Consider purchasing insurance for your physical gold to protect it from theft or damage.

4. Regularly check on your gold: Make sure to periodically check on your gold to ensure it is still in good condition and hasn’t been tampered with.

Investing in gold can be a great way to diversify your investment portfolio and protect against economic uncertainties. By following the tips and information provided in this article, you’ll be well on your way to becoming a successful gold investor. Remember to always do your research and consult with a financial advisor before making any investment decisions.